are combined federal campaign donations tax deductible

For nearly 20 years the US Office of Personnel Management has designated the ARRL participant 10099 to participate in the Combined Federal Campaign. The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC.

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

If interested in making a stock donation please call MACV headquarters at 651-291-8756 for more information.

. The CFC is comprised of 30 zones. Federal retirees and contractors working in a federal facility can also make a one-time deduction. Can I deduct my contributions to the Combined Federal Campaign CFC.

To make your tax-deductible donation right now to ADDA a 501c organization please fill out and submit the form below. Click here to access our most recently available annual financial statements. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done.

Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual. Your donation in any amount pooled with donations of other employees will go a. Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees.

Federal law does not allow for charitable. Is this your nonprofit. Follow this link to find out.

Donors who are eligible to itemize charitable. While tax deductible CFC deductions are not pre-tax. AMVETS Charities is committed to using every dollar you donate through CFC to directly serve our fellow veterans.

Your tax deductible donations support thousands of worthy causes. While tax deductible CFC deductions are not pre-tax. Our number for the campaign is CFC 10328.

Food For The Poor is an approved charity through the Combined Federal Campaign. Your generous tax deductible donations allow us to carry out our mission. The Combined Federal Campaign CFC The Combined Federal Campaign promotes and supports philanthropy.

The Combined Federal Campaign is happening now until January 15 2022 allowing personnel and retirees to pledge monetary support and volunteer time to approved. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. For nearly 20 years the US Office of Personnel Management has designated the ARRL participant 10099 to participate in the Combined Federal Campaign.

This year the CFC. YOUR CFC DONATION TO ACUF IS ALSO. From travel to trade American diplomacy has built bridges from the United States to others around the world.

Combined Federal Campaign Foundation Inc. Federal Tax ID 54-1642754 See your tax advisor for details. This annual campaign for federal.

Access the Nonprofit Portal to. ADDAs CFC designation code is 11589. Our Combined Federal Campaign number is 10519.

Provides ACUF with unrestricted. Chesapeake Care Clinic is a 501c3 nonprofit organization and donations are tax deductible. Is a 501c3 organization with an IRS ruling year of 2009 and donations are tax-deductible.

Your donation during the 2021 Combined Federal Campaign CFC 30585. According to OPM you can deduct even if you take the standard deduction and do. Thank you for contributing through the Combined Federal Campaign CFC.

Medical and dental care are basic. CFC allows employees to give a set recurring amount each pay period through payroll deductions. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax.

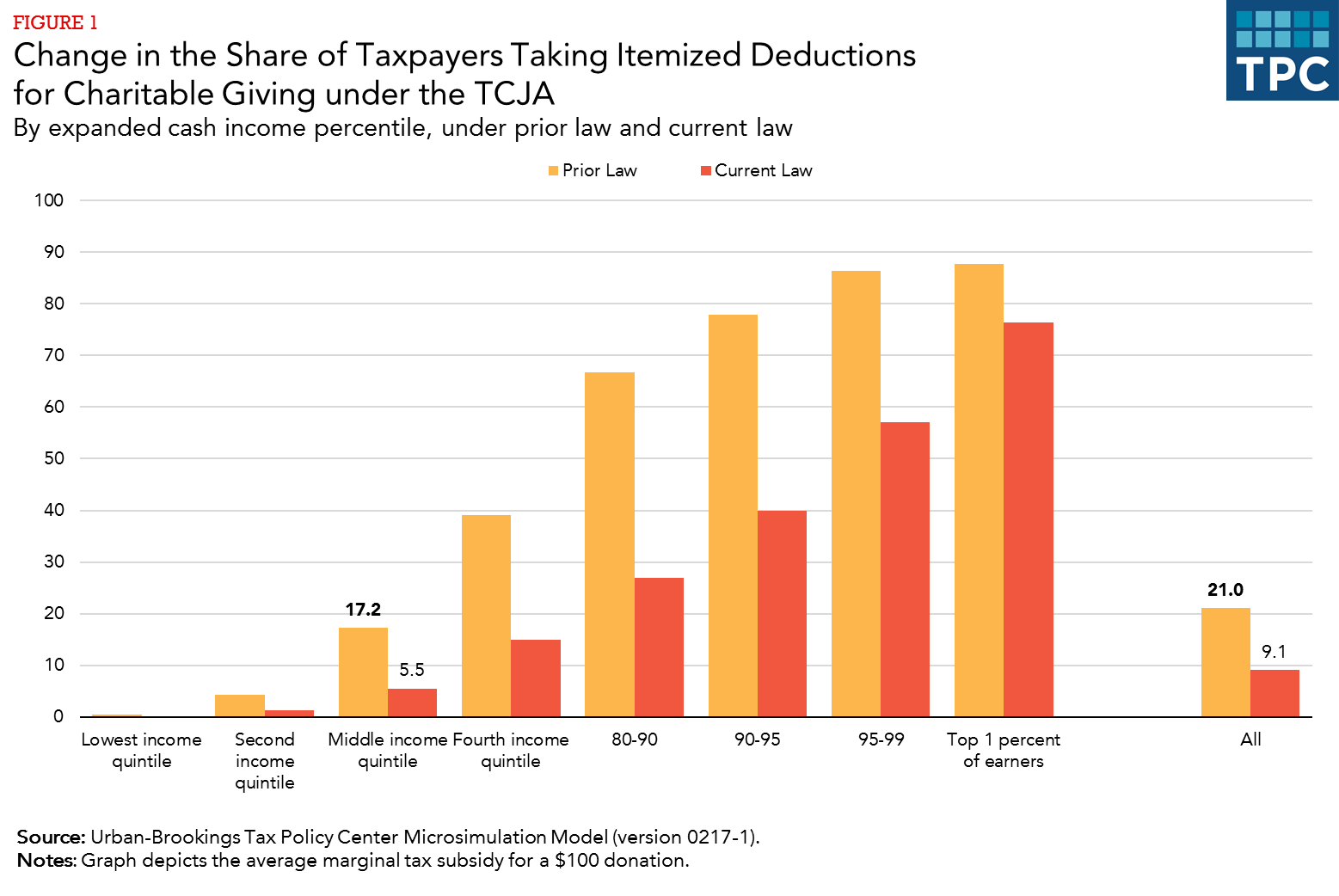

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

Tax Deductible Donations Can You Write Off Charitable Donations

Charitable Deductions On Your Tax Return Cash And Gifts

Nonprofit Tax Programs Around The World Eu Uk Us

Tax Benefits Of Charitable Donations 2022 Turbotax Canada Tips

How Much Should You Donate To Charity District Capital

Tax Deductible Charitable Donations Gifts That Give Back

Donate To Psc Partners Help Find A Cure For Primary Sclerosing Cholangitis Psc Partners Seeking A Cure

Donation Tax Credit How It Works For Personal Tax And Corporate Tax

Combined Federal Campaign Wikipedia

Are Crowdfunding Donations Tax Deductible In Europe

The Charity Industry And Its Tax Treatment Bp 401e

Tax Deductible Donations Can You Write Off Charitable Donations